If you commit to investing $5,000 per year for your retirement, would you rather end up with $505,000 or $1 million at age 65? It sounds like a no-brainer, but many people miss out on the full benefits of their retirement savings by not setting concrete, achievable financial goals.

If you commit to investing $5,000 per year for your retirement, would you rather end up with $505,000 or $1 million at age 65? It sounds like a no-brainer, but many people miss out on the full benefits of their retirement savings by not setting concrete, achievable financial goals.

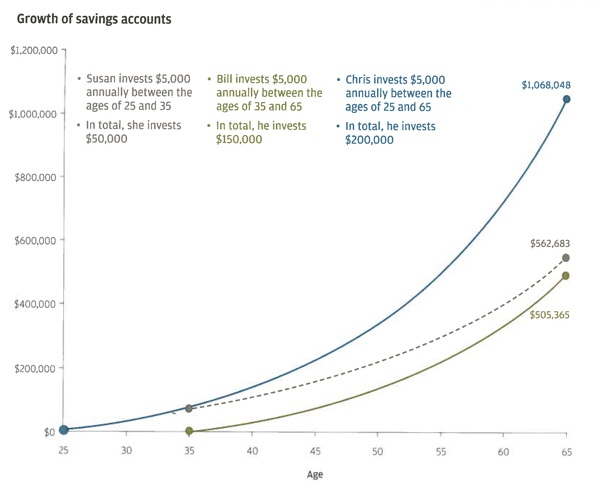

Setting concrete financial goals and reviewing them regularly helps ensure that you get the most from your retirement savings, such as by taking advantage of tax deferral and compounding. A person who starts saving $5,000 per year at age 25 would save a total of $200,000 and end up with $1,068,048 (assuming a 7 percent annual return). A person who starts saving at age 35, however, would save a total of $150,000 but end up with only $505,365 — benefiting far less from the power of compounding over time.

But many people have only vague retirement goals, such as, “I just want to make sure I’m able to live the same lifestyle without having to work as much as I do now or at even at all.” Others may have no clear goals at all, and just plan to work as long as possible and hope for the best.

There are a variety of reasons why people resist the goal-setting process, from procrastination and fear of making mistakes to feeling too overwhelmed by day-to-day obligations to think ahead. Others may delay taking action because they’re worried they haven’t done enough and feel embarrassed.

Some professionals or business owners rely too heavily on their business assets to meet their retirement needs, and face significant setbacks when they can’t sell those assets for as much as they’d hoped. A dentist, for example, may earn a good living from his or her practice and enjoy a high standard of living while working, only to realize that the value of the practice they’d hoped to sell doesn’t allow them to maintain that lifestyle and position in the community.

Turning Vague Aspirations Into Quantifiable Financial Goals

An example of extremely specific retirement goals might go something like this: “When I turn 67, my wife and I are moving to the Florida Keys and buying a nice place on the water with a boat slip and the Monterey Yacht off the back. Our family will come see us when possible, and we’ll go back to Maine in the summers. I plan to do some consulting work and my wife is going to volunteer for the American Lung Association.”

But these specific goals don’t just magically materialize — it’s a process. Life moves fast, so it’s important to start thinking about your future dreams now. As you get closer to retirement age, the specifics come into greater focus. The important thing is to start turning vague aspirations into goals early on.

Here are five steps to start today:

1) Summarize your aspirations in a paragraph or brief oral statement. Then, begin fleshing out concrete details by answering increasingly specific questions. Your answers to these questions further define what’s important to you, helping to shape your retirement lifestyle goals.

Examples include:

- Where would you see yourself ideally at age 55? How about 65 and 75?

- If you didn’t work anymore, what would you do with your time?

- What are your hobbies, and what would you do with more time to spend on them?

- What would be an ideal weekend or dream vacation for you?

2) Estimate the budget you’ll need to achieve your target lifestyle. This estimate is usually based on general assumptions about the larger actions you plan to take. Working with financial advisors is helpful in making sure your assumptions are on track.

For example, a person in their 40s and 50s often has equity in a larger primary home, but may want to downsize that house in retirement and buy a second home in Florida. A common assumption is that you should use all of your principal and savings to accomplish this goal, selling the primary house and using all of the equity and savings to buy the two homes outright.

In fact, using mortgage financing would be a much smarter decision (particularly now, when interest rates are low) and using that principal to live off as retirement income.

3) Draft each retirement goal. Give each goal a name or names (Florida Keys house, etc.) and outline the costs and investment needed to achieve it.

4) Project your current cash flow into the future. This allows you to see how today’s planning contributes to achieving your future goals.

5) Consider any threats to reaching your financial goals. These threats come from many areas, including fluctuating market returns, unforeseen healthcare costs and higher taxes on retirement income. People often take their current earning power as a given, for example, but if you’re laid off by your company and take another job with lower income, that could have an impact on your retirement.

Another common threat to your retirement goals that should be considered is when a family member or members need your financial help. Often, elderly parents end up relying on their children if they failed to plan appropriately for taxes, healthcare or other unforeseen expenses.

By working through these five steps, you’re able to turn vague aspirations about the future into concrete financial goals and mitigate risks to your plans for retirement.

Now that you have these goals in place, take time to visualize the joy and rewards of achieving them. Making good decisions now and in the near future has a huge impact on your long-term success, and knowing you’re on the right track brings you greater focus, clarity and peace of mind.

To secure your family’s financial future, you need a smart strategy and sound financial planning. Take the first step by downloading a complimentary copy of Checklist For Securing Your Family’s Financial Future.

Richard Brothers Financial Advisors